CeFi typically requires Know Your Customer (KYC) compliance, which confirms a user’s identity before they will begin using a centralized change open Finance vs decentralized finance. By authenticating the person’s id, KYC seeks to help forestall tax evasion, cash laundering and terrorist funding. Operating your personal validator or sustaining a staking setup requires hardware, technical information, and constant uptime. Protocols handle all validator operations, together with node selection, monitoring, and upkeep. This opens staking to customers who may lack the assets or expertise to function staking infrastructure on their own.

Main Options Of Defi

By downloading this guide, you may be also subscribing to the weekly G2 Tea newsletter to receive advertising news and tendencies. Knowing when you’re ready (and if you’re not) is a half of https://www.xcritical.in/ the accountability that comes with decentralization. This space rewards warning, impartial considering, and a long-term approach far more than hype-driven motion. Understanding whether or not DeFi aligns with your objectives, threat tolerance, and technical consolation may help you keep away from avoidable losses and misplaced expectations. In Accordance to DLNews, 69 hacks last year price DeFi platforms more than $735 million.

These exchanges wield the authority to disclose handle possession information to law enforcement, underscoring a elementary distinction between DeFi and CeFi privacy approaches. If you’re looking to earn staking rewards with out dropping entry to your funds, liquid staking is difficult to disregard. It’s already a key part of how capital strikes through DeFi in 2025. Token holders want to understand the risks, not simply the returns—smart contract failures, validator performance, and market volatility still apply. If you’re comfy with that tradeoff and choose your platform rigorously, liquid staking can be a smart approach to stay versatile while placing your crypto to work. The emergence of blockchain, which makes cryptocurrency potential, has additionally allowed for decentralized finance (DeFi).

What’s Defi?

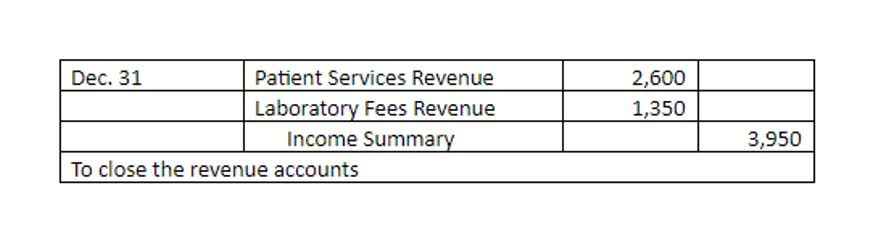

The following image summarizes a concise recount of the key differences between centralized vs. decentralized finance, which will hopefully help you weigh your determination on your own product. In this manner, everyone on the blockchain retains their own ledger in addition to everyone else’s ledger too. This makes decentralized transactions on the blockchain very protected. Anytime a new transaction happens, everybody’s ledgers are updated, not solely the ledgers of those really partaking within the transaction. When a transaction is recorded in a mess of ledgers, rather than in just some (like in the centralized system), it becomes very difficult for this information to be altered. Decentralized is a new system that manages financial transactions corresponding to transfers, mortgages, and loans.

Decentralized Finance: How Defi Replaces The Middlemen

Unlike DeFi, CeFi depends on intermediaries to facilitate transactions and handle property. There are totally different AML Risk Assessments professionals of DeFi that enable users to get more from their money and be energetic on the blockchain. The query is whether users ought to trust folks or know-how, despite the very fact that DeFi and CeFi differ significantly. With DeFi, cryptocurrency transactions — including shopping for, selling, loans and payments — can be enabled in a peer-to-peer strategy.

While good contracts scale back human error and fraud dangers, they’re susceptible to malicious hackers. Good contracts with vulnerabilities might enable hackers to steal consumer funds with little to no protection offered to the victim. According to Tyler Pearson for DLNews, 69 hacks in 2023 price crypto firms and DeFi protocols over $735 million. Banks and different financial establishments maintain and manage user funds in traditional finance.

- Efficiency is the secret when it comes to decentralized finance’s financial benefit, and is achieved via automation.

- DEXs aren’t supposed to behave as authorities for executing transactions, however can serve to assist enable the flow of transactions.

- Even dipping a toe in means you’re exploring the monetary future.

- In Contrast To DeFi, CeFi relies on intermediaries to facilitate transactions and handle property.

- And my DeFi pockets assist me to be versatile doing transactions and nonetheless have entry to tokens which are very early stage.

- Malleability is decided by the regulatory necessities placed on the order during which a transaction should be executed.

They can make transactions, lend, and borrow what they want on their phrases by accessing their secure pockets somewhat than seeking approval or permission from a central authority. This stage of autonomy fosters individual ownership and accountability for monetary choices without dictated phrases. It provides structural advantages that change how users work together with financial systems.

Gate crypto buying and selling launches within the US, reworking the market with new trading pairs and regulatory clarity. Common good contract audits are important to identify vulnerabilities. Diversifying investments across a number of platforms can alleviate liquidity issues and market volatility. Decentralized Supplied Rates (DOR) perform as newly adopted rates for fixed-income merchandise within DeFi.

Whether you’re depositing funds or borrowing against collateral, you are subject to how that protocol enforces danger and value. To understand how tokens can characterize tangible assets like real estate or equities, discover what asset tokenization means in a blockchain context. DeFi is the monetary engine of Web3 —the next evolution of the internet that doesn’t just connect folks and information, however worth. Now, Web3 brings possession, decentralization, and direct interaction—with DeFi powering how cash flows via it.

Decentralized Finance removes obstacles and middlemen, DeFi can convey monetary services to people who’ve by no means had them. Someone with a smartphone in a remote space can now entry a world market or safe a microloan with no native bank infrastructure. These totally different monetary methods all have unique ways of managing property, buying and selling belongings, and investing in belongings, all with their strengths, weaknesses, and functions. With the rise of crypto, DeFi and CeFi is something everyone should learn about if they need to perceive the world of finance at present.